Federal Income Tax Chart 2025. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: This will apply to workers aged 21 or over.

Although the adjustment is lower than last year’s, it remains relatively high compared with annual. You pay tax as a percentage of your income in layers called tax brackets.

The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Tax rates for the 2025 year of assessment Just One Lap, Income phaseouts for education benefits. Social security and medicare tax for 2025.

T130159 Baseline Distribution of and Federal Taxes; by, Want to estimate your tax refund? Select new ev models can qualify for a tax credit of up to $7,500, which you can apply at the time of sale to reduce your purchase price.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Previous year income tax rates. Last updated 21 february 2025.

20242024 Tax Calculator Teena Genvieve, Social security and medicare tax for 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

How Federal Tax Rates Work Full Report Tax Policy Center, Social security and medicare tax for 2025. Tax rates and tax credits for children.

Tax Rates 2025 To 2025 2025 Printable Calendar, The federal income tax consists of seven marginal tax brackets, ranging from a low of 10% to a high of 39.6%. Want to estimate your tax refund?

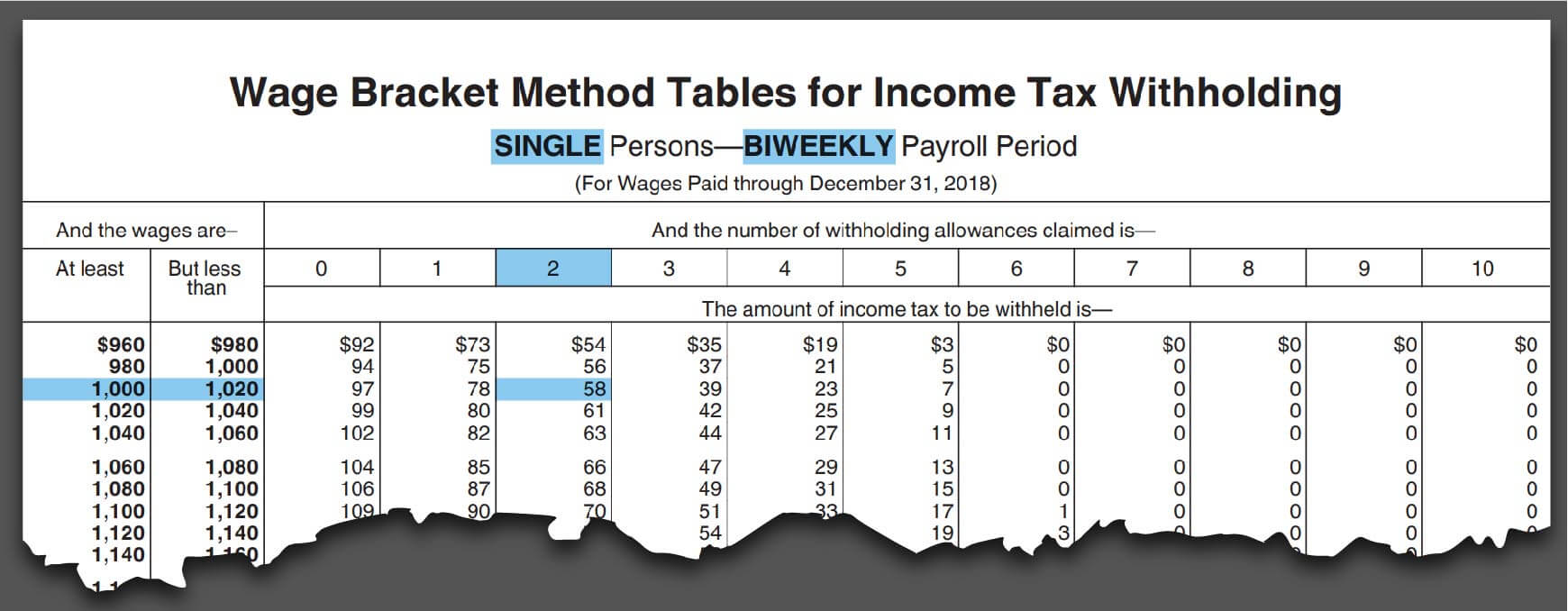

What Is Federal Tax? Withholding Guidelines and More, Previous year income tax rates. Last updated 21 february 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: From 1 april, the national living wage will be rising to £11.44.

Publication 17, Your Federal Tax; Tax Tables Taxable, Tax rates and tax credits for children. Here you will find federal income tax rates and brackets for tax years 2025, 2025 and 2025.

T130241 Distribution of Federal Payroll and Taxes by Expanded, The federal standard deduction for a single filer in 2025 is $ 14,600.00. Income phaseouts for education benefits.

As per section 192a tds rate on pf withdrawal for employees without pan reduced to 20% from the maximum marginal rate.

Travel Hiking WordPress Theme By WP Elemento